When buying property with another person you are given the option on how to be registered on the title of the property with them: joint tenants vs tenants in common. But what is the difference between the two and is one better than the other? In this article we explain everything you need to know.

What is Joint Tenants?

Joint tenants (also known as joint proprietors) means you own 100% of the property jointly with the people registered as joint tenants with you.

Practically this means:

- When joint tenants die, the surviving owner(s) automatically become entitled to be registered as the sole owner(s) of the whole of the interest in the property. This means that any property owned in joint tenancy do not form part of a deceased's estate, rather their interest automatically goes to the surviving owner(s). This is called "the right of survivorship".

- You have an even split of the property's profits, losses, and risks.

- You cannot have an uneven share in the property. All joint tenants own the property 100% jointly. For tax purposes the shares are even.

What is Tenants in Common?

Tenants in common means you have a defined ownership share of a property title. This can be 50-50, 60-40, 99-1 or any other combination.

Practically this means:

- On the death of either of the owners, the deceased’s interest in the property passes to his or her beneficiary (not necessarily the surviving owner on the title). The beneficiary is dictated by the deceased's Will or if they do not have a Will by State law.

- The property's profits, losses, and risks are split by the defined ownership share.

Can you do both Tenants in Common and Joint Tenants at the Same Time?

Yes you can if you have three or more owners on the title. For example person A and B hold a 50% share of the property as tenants in common jointly, while person C holds their 50% share as a tenant in common individually.

Practically this means:

- On the death of either person A or B who hold their 50% share jointly, the survivor of A or B will get the full interest of the deceased share. Person C will not have any claim to this share as they did not hold that 50% share jointly.

- If person C passes away, person A and B will have no automatic interest in person C's share of the property. Rather person C's share in the property will go to their beneficiary in accordance with their Will or State law if no Will exists.

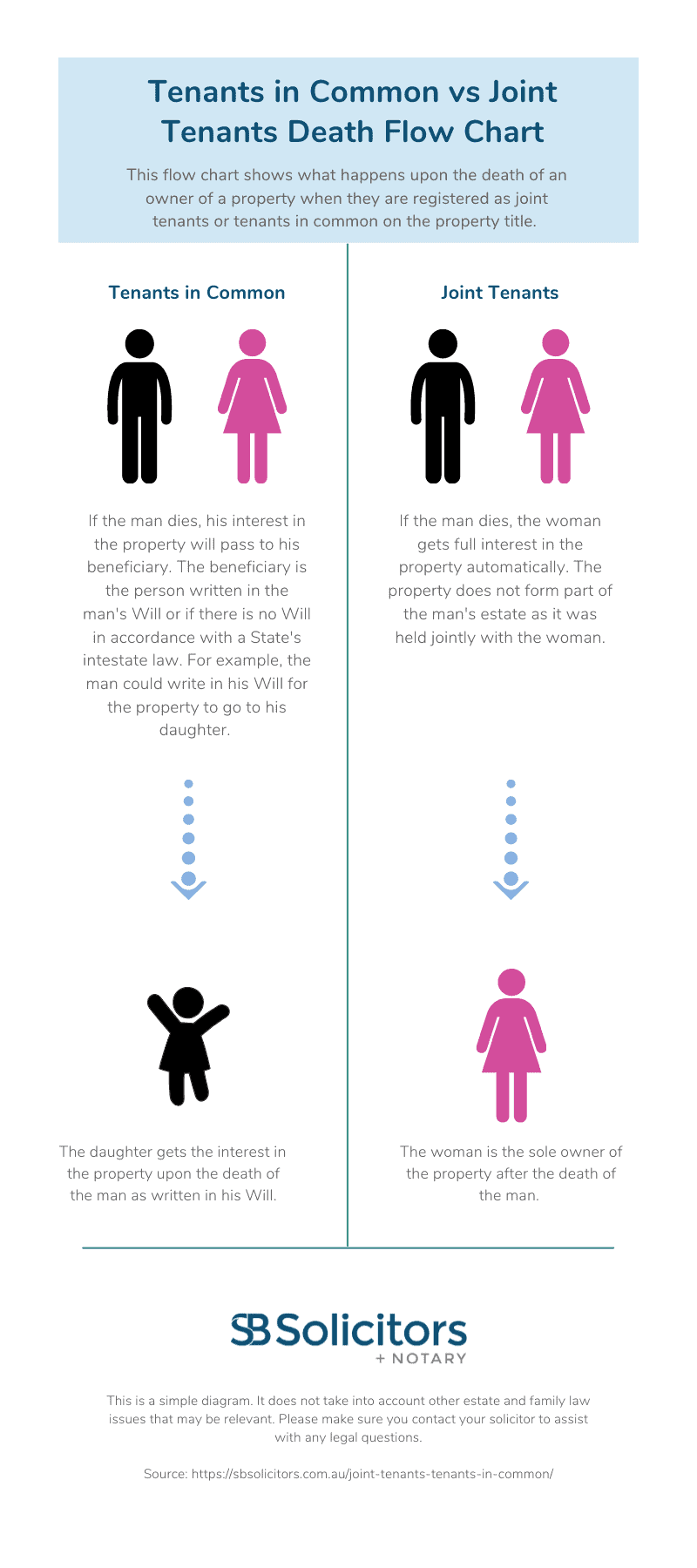

Tenants in Common vs Joint Tenants Diagram

The below is a simple diagram showing what happens if you die as a joint owner or tenant in common. Feel free to share it.

As you can see from the above diagram in joint tenancy the surviving joint tenant is guaranteed the property.

Joint Tenants vs Tenants in Common Tax Implications

The final consideration on how to be registered on the title of the property is tax implications.

If you register on a title of a property with joint tenancy you share of the property's tax liability evenly. For example, if two people own a property as joint tenant their tax liability is 50-50.

Tenants in common on the other hand allows you to set what your ownership share is and therefore your tax liability is based on your ownership share: 50-50, 60-40, 99-1 etc. In some circumstances it can make sense to have one person hold a greater share in the property, for example a lower earning spouse. You should get tax planning advice from your accountant before committing on your ownership share.

Should You Register as Joint Tenants or Tenants in Common?

Clients often ask what is the better way to be registered on the title of their property. The answer can be found by asking yourself the two questions below:

- What do you want to happen to the property upon your death? Do you want it to go to the surviving owner on title or someone else?

- What are your plans for the property? Is it you home or investment? If it is an investment property do you need to do tax planning?

Once you answer the above two questions it will become clear what is the better option for your circumstance.

Common Title Ownership Examples

Below are some common scenarios that our office sees every day from clients buying property in Melbourne. It should further assist you in how to be registered on title of the property. It is important to seek legal advice before your property is transferred at settlement.

Married Couple or Long Term De-facto Relationships

Most married and long term de-facto couples register on a property title as joint proprietors. This is because they want their spouse to have full interest in the property upon their death.

New Couples

New couples on the other hand may want to have their interest registered on the title as tenants in common as their relationship is new. It varies between clients. If they get married on later on and one spouse passes away, the transfer will go in accordance with the deceased's Will or if no Will by intestate law. So it is important to take into account estate planning. Previous relationships should also be taken into account.

Siblings and Friends

We typically recommend siblings/friends to be registered as tenants in common on a property title. In most circumstances if one married sibling/friend passes away they likely would want their share in the property to go to their surviving spouse or particular family member, not the other sibling/friend. Of course, there are some clients that want the sibling/friend to retain the full interest in the property.

Investors, Business Partners or Developers

In business dealings we recommend clients to be registered on the title of the property as tenants in common. This is because it creates clarity on the split of profits and losses from the property and keeps tax affairs straight forward.

Need Legal Advice or Have a Property Law Issue?

Please contact our law firm to arrange a consultation by calling 03 9708 5564 or filling in our contact form below. We provide legal advice in relation to property ownership including tenants in common disputes.