Please note we are not taking on any clients for caveat matters. But we hope this guide is useful.

You've probably heard the word "caveat" spoken in conversations about property. But what is a caveat? In this guide you'll learn everything you need to know about caveats - including what they are, how to lodge them, and how to remove them. The content is specific to the state of Victoria, but the principals apply to other states.

What Is A Caveat?

A "caveat" is a notice you can put on a property's Title to show you have an interest in the property. A caveat stops the Title Office from dealing in the property in specific ways without first giving notice to the person who registered the caveat.

For example if a property is being sold, the person that lodged the caveat will be informed and will be given 30 days to issue proceedings to stop the sale. In practice a caveat stops most transaction in their place as a bank is not willing to lend money if a caveat is on Title at settlement.

Why Lodge A Caveat?

You should lodge a caveat if you want to protect an interest you have in a property when you are not the registered owner.

For example if you've lent money to a person and the loan agreement allows it, you can lodge a caveat. If you've signed a contract to buy a house or lease a property, you can register a caveat in most circumstances. If your service agreement allows it, you can lodge a caveat. Or if you're going through a divorce and are not registered as an owner of a property your partner owns and you have an interest, you may lodge a caveat (this is common in family law matters).

Simply put you should register a caveat if you have an interest in a property but are not the owner. If you do not have a caveat registered over a property you cannot prevent the owner from dealing with the property. They could sell the property and you wouldn't know.

Who Can Register A Caveat?

Only people that have what's called a "caveatable interest" can register a caveat on a property. In order to have a caveatable interest you must either have a "legal" or "equitable" interest in a property.

An example of a legal interest is when you enter into a contract with a person and the contract allows you to lodge a caveat, for example: if you lend money to a person and the agreement allows the lender to lodge a caveat.

An example of an equitable interest are those interest in property that do not form part of contract law. There are only specific situations when this can occur, for example a purchaser in a property conveyance.

What If I Lodge A Caveat Without A "Caveatable Interest"?

If you lodge a caveat on a person's Title without the right to do it you can become liable to pay for the property owner's legal costs for removing it and pay compensation if the caveat causes losses. Because of this is very important that you seek legal advice from Melbourne property solicitor before you lodge.

What Does A Caveat Prevent?

A caveat stops property dealings being registered on the Title without the Title Office first notifying the the person who lodged the caveat. In Victoria this notification period is 30 days. Should the person who lodged a caveat not go to court to stop the dealing within set a timeframe, the dealing will register in most circumstances.

This means that a caveat is only good if you are willing to enforce it. However, even if you do not enforce your caveat it becomes an issue to a property owner when they want refinance or do a property sale, as no bank will want to register a mortgage or dealing on a Title with a caveat in place. This is when the Caveator obtains leverage against the property owner to negotiate an outcome that is to their favour.

Someone Owes Me Money, Can I Register Caveat Over Their Property?

There is a misconception if a person owes you money that you can register a caveat. You can only register a caveat if the person who owes you money has given you written permission to register a caveat. This is typically outlined in your loan or service agreement you have with your debtor. If you have no such agreement, then you cannot register a caveat.

How Long Does A Caveat Last?

The caveat will remain on the title indefinitely until it is removed by an application, court order, or by the Title Office in specific circumstances.

How To Lodge A Caveat

A caveat can be lodged by engaging the services of a property solicitor to firstly investigate if you have the right to lodge a caveat.

Lodging a caveat will involve reviewing any relevant documents and facts at hand. The solicitor will then draft the required paperwork and lodge the caveat at the Title Office.

The bulk of the work would be in the investigation stage, as a solicitor can only lodge a caveat if they reasonably believe their client has a caveatable interest. If a caveat is not lodged correctly penalties may apply as discussed earlier.

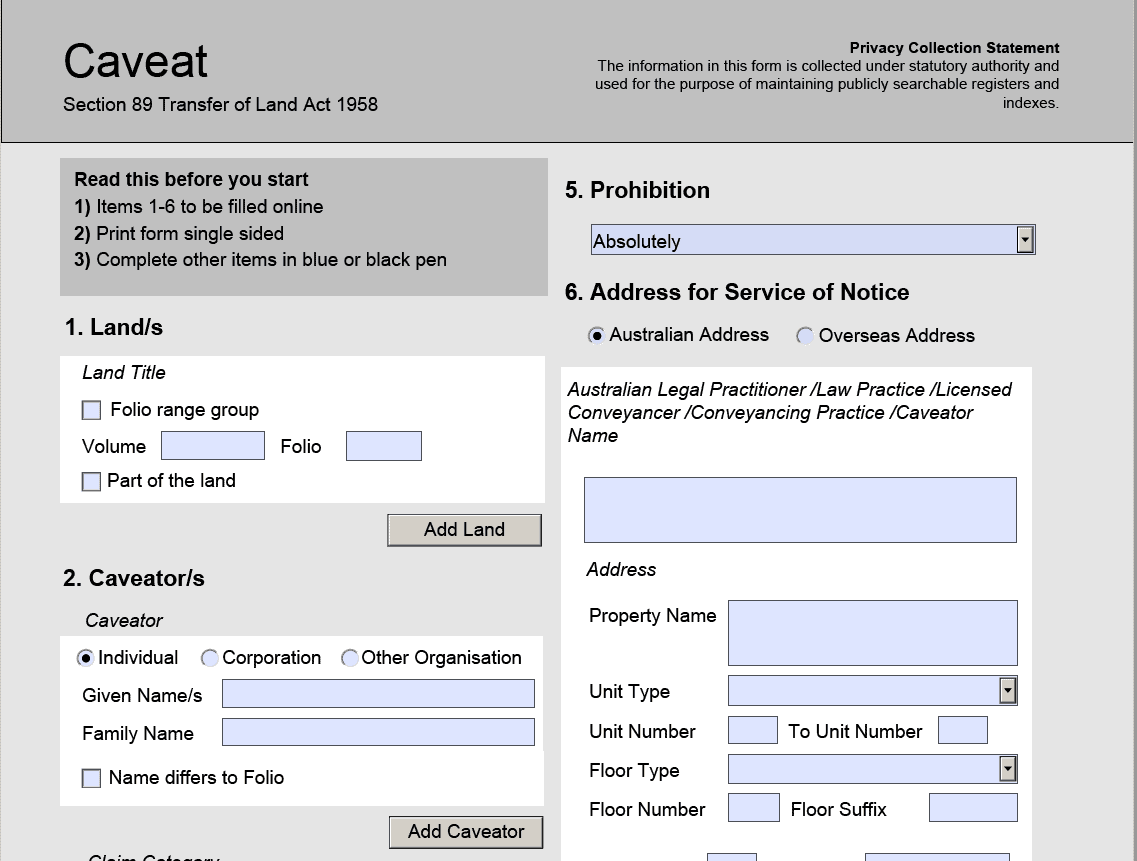

Most lawyers will be lodging caveats electronically using the PEXA platform. In some circumstances lodging a caveat can be done physically using the below form.

A blank caveat form that is lodged at the Title Office

How To Remove A Caveat in Victoria

There are main 3 ways to remove a caveat removed form a property:

- Lodging a Withdrawal of Caveat

The quickest and cheapest method to remove a caveat in some circumstances is asking the person that lodged the caveat to issue a "withdrawal of caveat" at the Title Office. This involves reaching out to the lawyer that lodged the caveat and asking them to seek their clients instructions to remove it. If the caveator no longer has any interest in the property, usually the lawyer will need their legal fees to be paid by you before issuing a withdrawal of caveat. - Lodging a Lapsing Notice

The second option is lodging a lapsing notice at the Title Office. You will need to lodge the correct form at the Title Office along with a certificate from a lawyer stating that in their opinion the Caveator no longer has any interest in the property.

This formal notice will then be forwarded to the person that lodged the caveat. If they do not respond within 30 days to the Title Office that they have commenced proceedings in the Supreme Court to enforce their caveat, the caveat will lapse and be removed from the Title.

This is a good option when you have clear evidence that the Caveator no longer has an interest in the property but you can't reach them to issue a withdrawal of caveat. If you do not have clear evidence that the caveat should be removed, a lawyer may not issue their certificate, as they risk being liable to the caveator for costs if the caveat was incorrectly removed by the legal notice. - Supreme Court Application

The final way of removing a caveat is by making an application to the Supreme Court to remove it. The person that lodged the caveat has the responsibility of proving that the caveat should remain on the Title of the property.

The court takes a "balance of convenience" approach to determine if a caveat should be removed or not. If the caveator does not commence proceedings to enforce the caveat or debt, the court will likely remove the caveat. If the caveator does not attend court, the court will issue an order to remove the caveat.

This method is the most expensive of the three methods, however it is appropriate in circumstances where you need to urgently remove a caveat (a hearing can be organised quickly) or if you do not have good evidence to get a lawyer to issue a certificate for a lapsing notice.

The best method to remove a caveat from a property depends on your individual circumstances. You should discuss your circumstances with a lawyer to determine the best method to take.

Statute Governing Caveats / Caveat Acts

The laws regarding caveats vary a little differently between states and territories. Below is the relevant legislation relating to caveats.

State or Territory | Legislation |

|---|---|

Victoria | Transfer of Land Act 1958 (VIC) |

New South Wales | Real Property Act 1900 (NSW) |

Australian Capital Territory | Land Titles Act 1925 (ACT) |

Queensland | Land Title Act 1994 (QLD) |

South Australia | Real Property Act 1886 (SA) |

Western Australia | Transfer of Land Act 1893 (WA) |

Tasmania | Land Titles Act 1980 (TAS) |

Northern Territory | Land Title Act 2000 (NT) |

Conclusion

Please note we are not taking on any clients for caveat matters. But we hope this guide has been useful.

Disclaimer: This guide relates to Victorian real estate law and should not be relied upon for legal advice but is general in nature. A consultation is required.